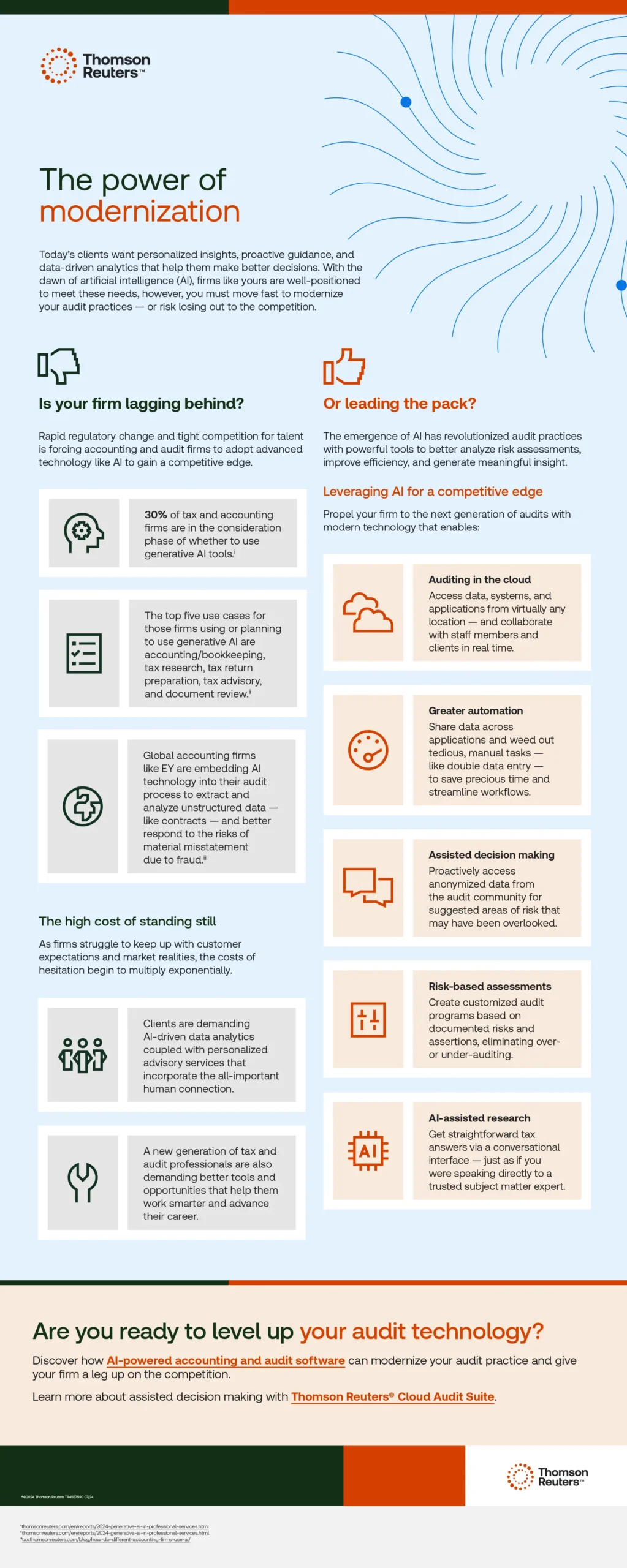

The Power of Modernization in Audit Practices In today’s fast-paced business environment, clients demand personalized insights, proactive guidance, and data-driven analytics to make informed decisions. The rise of artificial intelligence (AI) has positioned firms to meet these needs, but it requires swift modernization of audit practices to stay competitive. Here’s how leveraging AI can transform your firm’s auditing capabilities.

Is Your Firm Lagging Behind?

The accounting and audit industry faces rapid regulatory changes and intense competition for talent. Advanced technologies, especially AI, are essential for firms to gain a competitive edge.

AI Adoption Consideration: 30% of tax and accounting firms are contemplating the use of generative AI tools.

Top Use Cases: Firms are applying generative AI in accounting/bookkeeping, tax research, tax return preparation, tax advisory, and document review.

Global Implementation: Leading firms like EY utilize AI to extract and analyze unstructured data, such as contracts, to mitigate fraud risks and respond to material misstatements.

The High Cost of Standing Still

Failing to keep pace with customer expectations and market realities can lead to significant costs.

Client Demands: Clients expect AI-driven data analytics alongside personalized advisory services that maintain a human connection.

Workforce Expectations: New generations of tax and audit professionals seek advanced tools and opportunities to enhance their careers.

Or Leading the Pack?

The emergence of AI has revolutionized audit practices, enabling firms to better analyze risk assessments, improve efficiency, and generate valuable insights.

Leveraging AI for a Competitive Edge

Propel your firm into the next generation of audits with modern technology that includes:

Auditing in the Cloud: Access data, systems, and applications from any location and collaborate with staff and clients in real time.

Greater Automation: Share data across applications and eliminate tedious tasks like double data entry, saving time and streamlining workflows.

Assisted Decision Making: Utilize anonymized data from the audit community to identify potential risks that may have been overlooked.

Risk-Based Assessments: Develop customized audit programs based on documented risks, avoiding over- or under-auditing.

AI-Assisted Research: Obtain straightforward tax answers through a conversational interface, as if consulting directly with a subject matter expert.

![Online Coupon And Email Marketing Statistics [InfoGraphic]](https://samplevisualization.com/wp-content/uploads/2014/12/Online-Coupon-And-Email-Marketing-Statistics-InfoGraphic-feature-image-image-300x225.webp)

![Interesting Facts About Lunch By Countries [InfoGraphic]](https://samplevisualization.com/wp-content/uploads/2013/11/Interesting-Facts-About-Lunch-By-Countries-InfoGraphic-feature-image-300x225.webp)